The Smart Money Signal: Why AI in Sports Is Finally Worth Your Attention

3 Min Read

8 Deployment Signals You Shouldn’t Ignore

The Smart Money Signal: Why AI in Sports Is Finally Worth Your Attention

Let’s be honest for most investors, sports tech hasn’t exactly been hottest territory.

It’s niche. It’s fragmented. And it’s long been dogged by slow-moving customers, small budgets, and hard-to-scale models.

But something’s changed. Quietly, over the past 18 months, some of the world’s most traditional sports institutions — from the Bundesliga to Wimbledon, Formula 1 to the NBA — have moved from talking about AI… to fully deploying it.

Not pilots. Not press releases.

Live, scaled, revenue-producing deployments.

And for investors who know how to read the market — that’s not noise.

That’s a signal.

From “Too Early” to “Actively Buying”

Speak with any partner at a growth-stage VC or PE fund and they’ll say the same:

“It’s not about the tech — it’s about the buyer.”

“Is someone paying for this? Expanding? Renewing?”

Historically, the answer in sports was no.

But in 2024–25, something flipped. Why?

Generative AI became usable across non-technical teams

- Fan expectations soared

- Broadcasts demanded more dynamic content

- And clubs/federations came under pressure to diversify revenue

Suddenly, sports brands weren’t asking if they should use AI.

They were asking where to start.

8 Deployment Signals You Shouldn’t Ignore

Each of these isn’t just a use case — it’s market validation.

A clear sign that budget is flowing and real business value is being captured.

Bundesliga × AWS

AI-powered match insights (xGoals, Speed Alerts, Keeper Efficiency) now appear in every Bundesliga broadcast, live. In 2024–25, they added AI-generated multilingual commentary.

📌 Investor Insight:

AI is no longer “innovation” here — it’s infrastructure.

This is what mainstream adoption looks like.

Wimbledon × IBM

Using IBM’s watsonx, Wimbledon produces automated highlights and personalized reels — no editors. Their Catch Me Up format delivered 14.4M extra video views in 2024 alone.

📌 Investor Insight:

Content automation is now a revenue driver — not just a cost cutter.

That’s investable behavior.

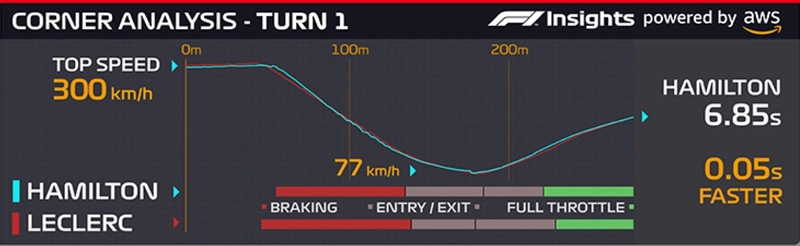

Formula 1 × AWS

F1’s Race Insights — Time Lost, Pit Strategy Battle, Overtake Likelihood — are calculated and delivered live to global broadcast feeds.

📌 Investor Insight:

This is AI-generated IP. The companies turning live data into premium content have a repeatable, monetizable playbook.

Spot the Pattern

These aren’t isolated cases.

They form a clear pattern:

Even the most conservative buyers in global sports are now adopting AI — not in labs, but in operations.

If Bundesliga is integrating AI into core broadcasts, if Ferrari is personalizing fan experiences in real time, if Serie A is generating thousands of video assets via automation — this is no longer early.

It’s the start of a platform shift.

🔎 More Proof Points

🏁 Ferrari × IBM

1M telemetry points/second processed to deliver personalized insights to 400M fans, in real time.

📌 Investor Insight:

Mass-scale personalization requires orchestration.

This is prime territory for infra-focused AI startups.

⚽ LaLiga × MediaCoach

Processes ~3.5M data points per match. Outputs heatmaps, momentum charts, tactical dashboards — syndicated to fans, coaches, broadcasters.

📌 Investor Insight:

This is data as multi-sided product. Startups powering insight delivery and UX here are entering a maturing buyer market.

🇮🇹 Serie A × WSC Sports

Automatically generates highlight packages across the league within minutes — fully sponsor-ready and personalized.

📌 Investor Insight:

Repeatable, scalable, and monetizable. It’s SaaS-meets-content.

💼 What Investors Should Be Asking

If you’re actively evaluating vertical AI or sports/entertainment tech plays, here’s your filter:

✅ Validation

Are buyers live and expanding?

Are budgets real, not pilot grants?

Are we beyond one-off experiments?

✅ Scalability

Can the product plug into existing workflows?

Can it scale across leagues or expand beyond sports?

Is it a feature, or a platform in disguise?

✅ Exit Potential

Who are the logical acquirers (media, cloud, sports tech)?

Is this solving an urgent, strategic problem?

Could this power multiple monetization streams (ads, fan data, broadcast, betting)?

This startup list is Gold:

Just finalized a shortlist of breakout AI startups in sports — real traction, real ROI, already working with top clubs.

Want the doc? Give me a shout.

AR

HYPE Sports Innovation

Comments